WHAT IF YOU HAD A CRYSTAL BALL THAT COULD FORECAST YOUR BUSINESS’S FUTURE CASH FLOW AND FINANCIAL SITUATION?

Do you often worry whether your business will have enough cash to survive in the long term, even if it’s doing well right now? There are some clear signs that outsourcing accounting and bookkeeping services can help. Do you worry about covering your business’s tax obligations? You need a tax CPA. Or, maybe you worry whether your company’s earnings will let you buy a house or send your child to college. You’re not alone. These are common questions and fears that many business owners face. In fact, some assume that these stressors are part and parcel of owning a small business. But they don’t have to be. In fact, they can inhibit your business’s growth. So, what can you do about it?

Stunted Growth

These fears arise from uncertainty. Every business owner would love to own a crystal ball to predict their company’s future. While large companies do have employees who focus on financial forecasting, small businesses cannot afford this level of staff specialization. Instead, as the owner of your small business, it falls to you to examine finances, and most must do so with limited information.

See if this sounds familiar: your CPA or bookkeeper gives you the data on your business’s recent performance, and because of how bookkeeping operates, this information is a month or two out of date. You check your company’s bank balance. Then, as the business owner, you’re on your own as you do the mental gymnastics to try to figure out what these numbers mean for your business’s future.

The cloudiness of this process can keep you from making decisions with confidence, which in turn keeps your business from operating at maximum efficiency and profitability. In other words, by trying to keep your business healthy entirely by yourself, you might actually be stunting its growth.

Financial Forecasting

But with help, you can find financial clarity and maximize your business. As a CPA and an attorney, I have made a commitment to serving small businesses. Outsourcing accounting and bookkeeping services is the first step to getting the help you need. Through technology, Unalp CPA Group can offer you our “crystal ball” expertise. We have developed a process where, for a nominal fee and as part of our accounting work for your company, we can project your future revenue, costs, profit and cash flow in much more detail than ordinary bookkeeping services.

Dynamic Accounting

Unalp CPA Group utilizes technology to seamlessly forecast your cash flow for the next twelve months, on a daily basis, based on the latest transactions in your bank account. We call this approach “Dynamic Accounting.” Whereas most accountants and bookkeepers just look at your numbers and tell you where you’ve been, we combine those numbers with our forecasting capabilities to tell you where you’re going. Outsourcing accounting and bookkeeping with us isn’t a static approach—it’s dynamic.

Most business owners operate based on the present, meaning the amount of money they currently have in the bank. But this is a big mistake. The simple fact is that by the time you see you’re running out of cash, it’s too late to avoid a negative effect. Forecasting cash flow, the process at the heart of Dynamic Accounting, is essential for allowing business owners to operate based on the future instead. Accurate cash flow projections allow you to make informed choices. Our system lets us run “what if” scenarios that predict the effects of various decisions you could make.

We Do the Work For You

Dynamic Accounting is necessary because your business’s numbers alone — your profit and loss — act only as general indicators of its health. Your numbers will not tell you, for instance, on what dates you might pay a vendor or receive payment from a client. Without a warning system, you could find yourself scrambling to bridge gaps in a month with lots of early payouts and later client payments. In other words, your business could be profitable and still run out of money. This is why Dynamic Accounting is so powerful. Our system anticipates these situations. We do the work for you.

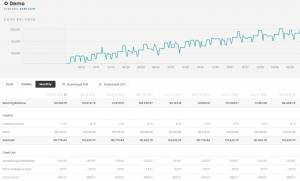

Consider these projections, based on a sample from our demo system (click to view a larger image):

At the top of the screenshot (where it says “Cash balance”), the graph tracks a daily projected cash balance across several months. This visual gives insight that, while this business has a positive cash balance, it is increasing considerably. It might be the case that this particular business often sees revenues fluctuate from month to month. Based on discussions with the business owner, we can manually alter the predictions from historical norms using the Adjustments row. But the upward trend in the overall cash balance is cause for further analysis. The business owner may be able to take additional distributions from the business, reinvest in the business, or increase retirement benefits. During a planning session with the owner, we can collaborate and track “what if ” scenarios to get the optimal outcome, making informed decisions to maximize the cash flow.

The Goal

As you can see, outsourcing accounting and bookkeeping services has many benefits. The goal of Dynamic Accounting is for us to predict your cash flow and then learn from those predictions as we move forward. We can also use Dynamic Accounting models to project new lines of business, helping you envision and plan for future endeavors. The longer we work with you, the more uniquely fine-tuned those predictions can become.

I want to help business owners move confidently into the future. While Dynamic Accounting will never be perfect — no type of forecast ever is — it will become one of your most useful tools in managing your business. Crystal balls in the movies are never completely clear, but if you had one, it would still give you an advantage over your competition. That’s what we’re here for.

Let’s Talk

Call Unalp CPA Group today at (925) 256-6321 and let us have 30 minutes of your time to show you how we can help transform your business to optimize its success.

Recent Comments